It’s Not Easy to Predict

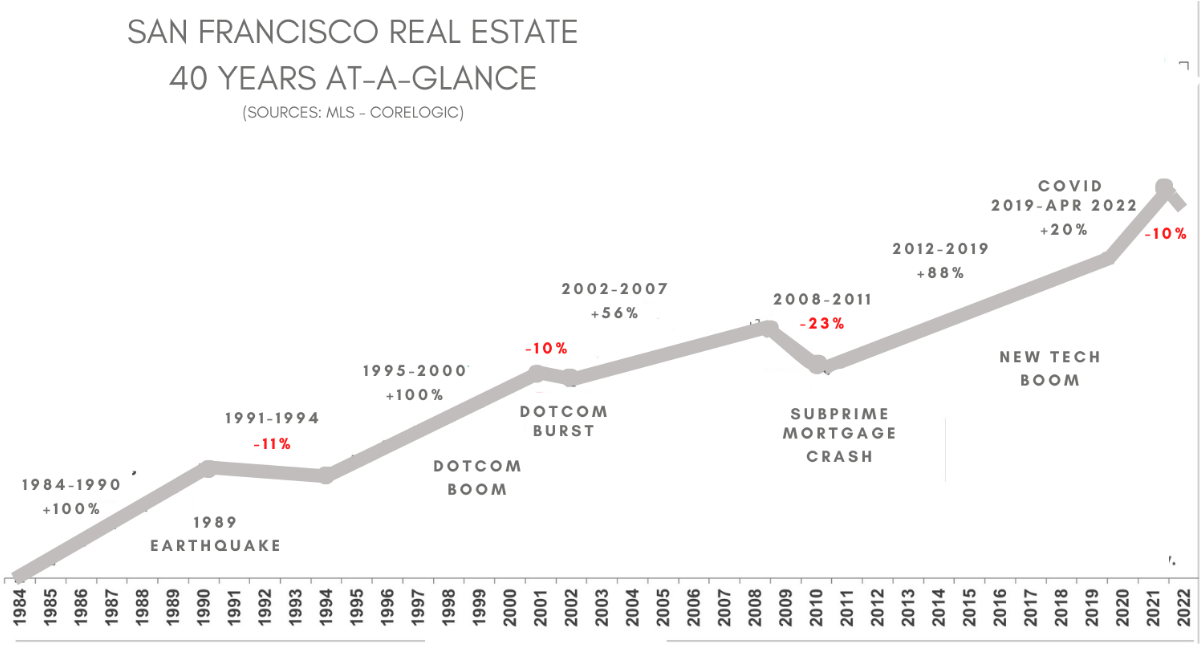

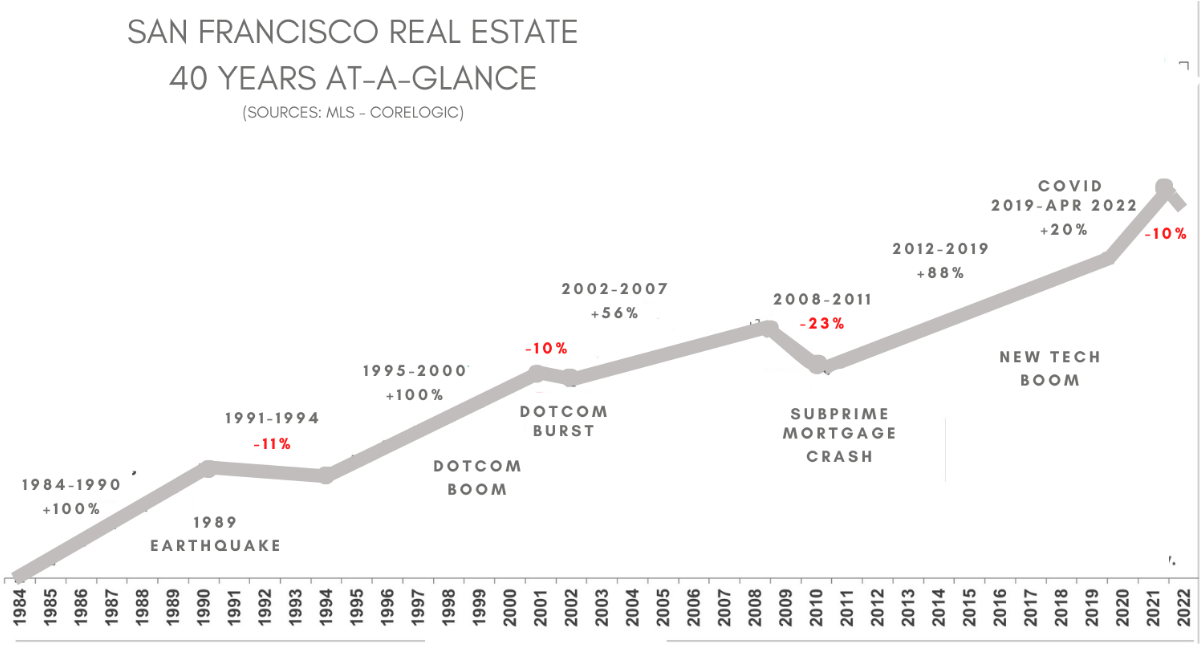

The market is not always easy to predict but looking back at the last 40 years of cycles in San Francisco real estate can provide perspective. The big picture shows the typical market dip at 10 – 11%. The greatest real estate downturn since 1984 happened during the subprime mortgage crash, from 2008 – 2011 when home values in San Francisco decreased on average by 23%. However, by early 2012, prices started to rise, and quickly. San Francisco home prices increased by 88% by 2019, while the U.S. home market rebound by only 50%. When the pandemic hit, San Francisco prices continued to climb by another 20% — until mid-2022.

Since April, median home prices and the average price per square foot in San Francisco fell rapidly, by about 10% and as much as 19% for condos.

Date the Interest Rate

You’ve read about high mortgage rates — they are usually temporary — we like to say, marry the house, date the interest rate! If you can qualify for a home in this market, it can be more important to consider the price of the home than the interest rate. For the first time in 11 years, we are seeing home prices come down. The price reduction today will compensate for the higher interest rate and some of that interest can typically be deducted from your tax bill. Call us to help you understand the numbers for your potential buy.

Banks Want Your Business

The banks want your business, and they are getting creative in their offerings. You know about 30-year mortgages — now you can get 40 years. Not only that, but you can also take a loan against your stock without selling it. |